Eli Lilly, a giant in the pharmaceutical industry and one of the most valuable healthcare companies globally, recently reported third-quarter earnings that failed to meet Wall Street’s expectations. The earnings miss has triggered an 11% drop in Lilly’s stock value—the largest one-day decline the company has seen in 16 years.

The primary factors behind the disappointing earnings report were weaker-than-expected sales for two key drugs: Mounjaro, a diabetes treatment, and Zepbound, a weight-loss drug. Lilly’s Mounjaro brought in $3.1 billion, while Zepbound generated $1.3 billion in sales—both numbers falling short of analysts’ projections, which had estimated sales of $3.8 billion for Mounjaro and $1.7 billion for Zepbound.

Inventory Adjustments and Strategic Shifts

The sales declines were partially attributed to a decrease in inventory by wholesalers, who had built up stock in previous quarters. Lilly’s CEO, David Ricks, noted that the company has strategically delayed further advertising for Zepbound and held back international launches to concentrate on meeting inventory demand in the U.S. Ricks explained that while demand for the drug remains strong, Lilly chose to pause certain promotional activities to address supply issues.

Impacts on Full-Year Forecasts and Analyst Reactions

Due to these setbacks, Lilly adjusted its 2024 forecast, lowering its anticipated full-year earnings per share (EPS) to a range between $13.02 and $13.52, down from the previously estimated $16.10 to $16.60. This revision comes after an earlier optimism-driven increase that had already exceeded Wall Street’s expectations. The company also reduced the upper limit of its revenue outlook by $600 million, citing higher-than-expected acquisition and manufacturing costs.

TD Cowen analyst Steve Scala expressed interest in whether this unexpected decline in sales is merely a temporary adjustment due to inventory rebalancing or indicative of a lasting trend.

Substantial Investments Amid Rising Competition

Despite the recent setback, Eli Lilly has been pouring billions of dollars into expanding production capabilities to meet the unprecedented demand for its GLP-1 drug portfolio, which includes both Mounjaro and Zepbound. GLP-1 drugs have gained considerable attention for their effectiveness in managing weight loss and diabetes, and the market for such treatments is projected to reach $150 billion in revenue over the next decade. Eli Lilly and its Danish competitor, Novo Nordisk, are both racing to expand production and meet the rising demand.

In addition to ramping up production in Indiana, Lilly has invested in new facilities in Ireland. The company has also introduced a direct-to-consumer platform that allows patients to purchase vials of its weight-loss drug at discounted rates.

Broader Market and Future Potential

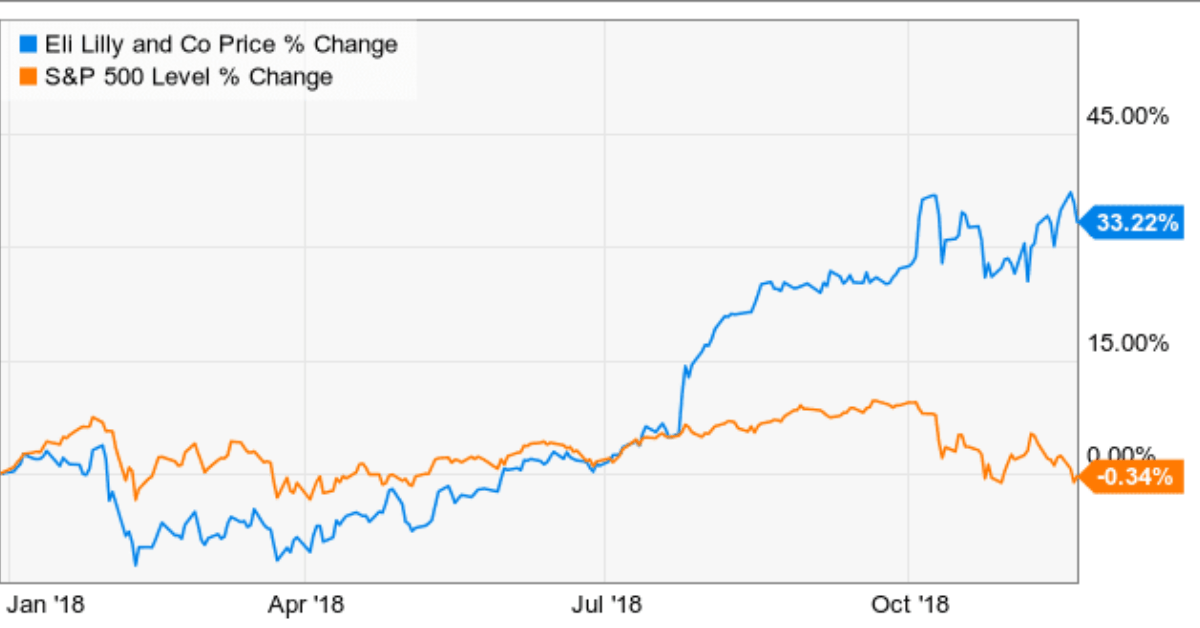

Even with the current challenges, Eli Lilly’s stock is up 55% this year, showcasing investors’ confidence in the company’s long-term potential. Much of this optimism stems from the potential of Lilly’s weight-loss and diabetes treatments, which could catapult the company to new heights in the healthcare industry. Furthermore, Lilly is developing a new Alzheimer’s drug, Kisunla, which could become a major player in a market currently dominated by Biogen’s Leqembi.

In recent trials, Kisunla has shown promise in reducing side effects, such as brain swelling, when administered at lower starting doses. Such advances, coupled with the strong demand for GLP-1 drugs, have positioned Lilly as a formidable contender in the global healthcare landscape.

Looking Forward

Eli Lilly faces a critical period as it seeks to resolve its inventory issues and restore investor confidence. The company’s strategic decisions regarding production, advertising, and product accessibility will play a significant role in its future performance. Whether the current slowdown is a minor setback or a sign of a more significant trend, investors and industry analysts alike are keeping a close watch on Lilly’s next moves.